Trade Forex with Multipliers

Trade Forex with MultipliersJoin Deriv.com What Is Deriv? Deriv.com is an online trading platfor...

Knowledge and Education: Gain a strong understanding of forex trading by studying fundamental and technical analysis, exploring various trading strategies, and staying informed about market trends. Utilize educational resources and reputable platforms to enhance your knowledge. These can help to make consistent money with Forex.

Create a well-defined trading strategy that aligns with your risk tolerance, trading goals, and preferred style (such as day trading or swing trading). Test your strategy using demo accounts or paper trading before risking real money.

Protect your capital by implementing risk management techniques. Set appropriate stop-loss orders, calculate position sizes based on your risk tolerance, and avoid excessive leverage. Maintain discipline and avoid emotional decision-making.

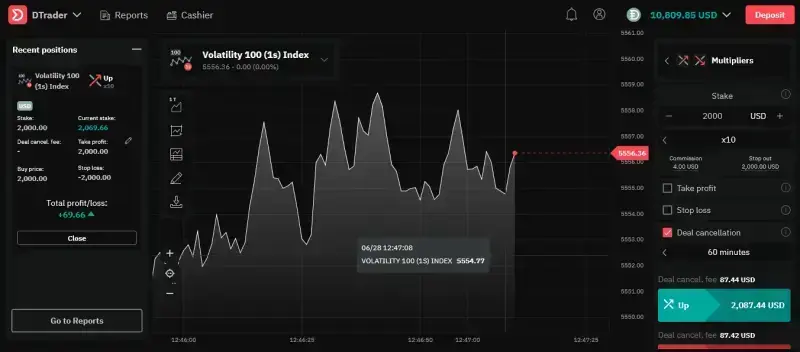

Utilize technical analysis tools like chart patterns, indicators, and price action to identify potential entry and exit points. Combine technical analysis with fundamental analysis for a comprehensive view of market conditions.

Establish a consistent money management plan that determines the amount of capital to risk per trade and the maximum number of concurrent trades. Avoid risking a significant portion of your account on a single trade and maintain a diversified portfolio.

Control your emotions and avoid impulsive decisions driven by fear or greed. Stick to your trading plan, avoid chasing losses, and resist deviating from your strategy during winning streaks.

Forex markets are dynamic, so continuously learn, adapt, and refine your trading strategies. Maintain a trading journal to analyze your trades, identify strengths and weaknesses, and make necessary improvements.

Use stop-loss orders to limit potential losses and take-profit orders to secure profits. These orders help manage risk and remove emotions from decision-making.

Select a reputable forex broker that offers competitive spreads, reliable trade execution, and a user-friendly trading platform. Ensure they are regulated by a recognized financial authority to safeguard your funds.

Success in forex trading requires patience and consistency. Avoid chasing quick profits or taking unnecessary risks. Stick to your trading plan and focus on long-term profitability.

Remember, forex trading involves risks, and there are no guarantees of consistent profits. Approach it with dedication, practice, and a realistic mindset. Start with small positions, and gradually increase trading size as you gain experience and confidence.

Comments